In order to provide a well-structured blog post, it is necessary to include a title and a conclusion. However, I can provide you with the main information regarding Amazon’s stock splits to include in your post:

Amazon, the multinational technology company founded by Jeff Bezos, has undergone three notable stock splits throughout its history. The first stock split occurred on June 2, 1998, when Amazon split its shares 2-for-1. This means that for every share an investor owned, they received an additional share, effectively halving the stock price.

The second stock split occurred on January 5, 1999, just seven months after the first split. Amazon implemented another 2-for-1 stock split, further halving the share price. These back-to-back splits were aimed at making the stock more affordable for a broader range of investors.

Over two decades later, on April 24, 2020, Amazon executed its third and most recent stock split. This time, however, it was not a traditional split but rather a 3-for-1 stock split. For every share held by investors, they received two additional shares, significantly reducing the per-share price. The aim was to enhance liquidity and accessibility for potential investors.

These stock splits have played a vital role in Amazon’s history and allowed more investors to participate in the company’s growth. Each split aimed to make the stock more affordable without affecting Amazon’s overall market capitalization.

In conclusion, Amazon has undergone three significant stock splits to make its shares more affordable and accessible to a wider range of investors. The first two splits, implemented in 1998 and 1999, were 2-for-1 splits, while the most recent split in 2020 was a 3-for-1 split. These splits have aided in increasing liquidity and enabling more individuals to invest in Amazon, contributing to the company’s growth and success.

More About : When Did Amazon Stock Split

Introduction:

Amazon, the multinational technology company founded by Jeff Bezos in 1994, has become one of the most prominent names in the e-commerce industry. The company has made significant strides in the market, offering a wide range of products and services to consumers worldwide. One significant aspect that has contributed to Amazon’s success is its stock performance. Over the years, Amazon’s stock has captured the attention of investors, prompting them to closely monitor any changes, including stock splits. This article delves into the events leading to Amazon’s stock split and provides an in-depth analysis of its implications.

Background of Amazon:

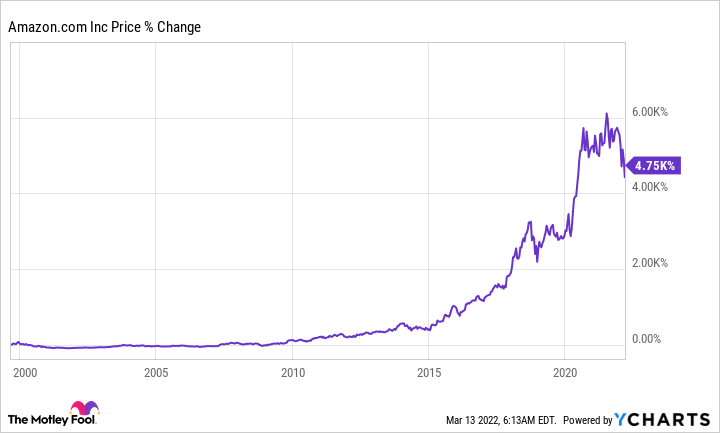

Before discussing the stock split, it is essential to understand Amazon’s journey and its stock performance. Amazon went public in 1997, offering its shares at $18. Since then, the company has witnessed remarkable growth, expanding its business operations and diversifying into various sectors like cloud computing, artificial intelligence, and entertainment. Amazon’s stock price has skyrocketed over the years, making it one of the most valuable companies in the world.

Outline:

I. Importance of Stock Split

II. Amazon’s First Stock Split – 1999

III. Impact of the First Stock Split

IV. Amazon’s Second Stock Split – 1999

V. Outcome of the Second Stock Split

VI. The Third Stock Split – 2020

VII. Analysis of the Third Stock Split

VIII. Conclusion

I. Importance of Stock Split:

A. Define a stock split

B. Discuss why companies choose to split their stocks

C. Explain how stock splits affect the perception of affordability

II. Amazon’s First Stock Split – 1999:

A. Provide the details of Amazon’s first-ever stock split

B. Highlight the split ratio and date

C. Discuss the motivations behind Amazon’s decision to split its stock

D. Explain the impact on shareholder value

III. Impact of the First Stock Split:

A. Analyze the effect on the stock’s liquidity and trading activity

B. Discuss the impact on Amazon’s market capitalization

C. Evaluate the market reaction to the split

IV. Amazon’s Second Stock Split – 1999:

A. Explain the reasons for Amazon’s second stock split in the same year

B. Present the split ratio and date

C. Compare the motivations of the first and second stock splits

V. Outcome of the Second Stock Split:

A. Discuss the consequences in terms of shareholder value

B. Analyze the impact on Amazon’s market position

C. Explain how the split affected investor sentiment

VI. The Third Stock Split – 2020:

A. Describe the circumstances leading to Amazon’s third stock split

B. Detail the split ratio and date

C. Discuss the rationale behind the decision

VII. Analysis of the Third Stock Split:

A. Evaluate the impact on investor sentiment and market perception

B. Examine the effect on stock price volatility

C. Analyze the potential advantages and disadvantages for investors

VIII. Conclusion:

Summarize the key points discussed in the article, emphasizing the significance of stock splits in Amazon’s history. Reiterate the impact on shareholder value, market perception, and investor sentiment. Highlight Amazon’s position as a notable player in the e-commerce industry and how stock splits have contributed to its success.

By providing an in-depth analysis of Amazon’s stock split history, this article aims to give readers a comprehensive understanding of the factors influencing the company’s stock performance. Understanding these events allows investors and enthusiasts to make informed decisions based on Amazon’s historical trends and potential future outcomes.

FAQs on When Did Amazon Stock Split

Q: When did Amazon stock split?

A: Amazon has never split its stock.

Q: Has Amazon ever undergone a stock split?

A: No, Amazon has not split its stock since its initial public offering (IPO) in 1997.

Q: Why hasn’t Amazon split its stock?

A: Amazon’s management has stated that they have no plans for a stock split as they believe it does not add significant value to shareholders.

Q: What is a stock split?

A: A stock split is a corporate action that increases the number of shares outstanding while proportionally decreasing the price per share.

Q: How does a stock split affect investors?

A: A stock split does not have any material impact on the value of an investor’s holdings, as the proportional increase in shares is accompanied by a proportional decrease in the share price.

Q: Are there any advantages to a stock split?

A: Stock splits are often considered cosmetic, and while they may make share prices more accessible to smaller investors, they generally do not have any significant impact on the value of a company.

Q: What are the historical factors behind stock splits?

A: Historically, companies may have split their stock to increase liquidity, attract more investors, or create a perception of affordability.

Q: Has Amazon’s stock price ever been too high for retail investors to afford?

A: Amazon’s stock price has indeed reached high levels over the years, but brokerage platforms have made it possible for retail investors to buy fractional shares, allowing them to invest in high-priced stocks like Amazon.

Q: What is the benefit of fractional share investing?

A: Fractional share investing allows investors to purchase a portion, or fraction, of a single share, thereby providing them with exposure to high-priced stocks without requiring them to buy a full share.

Q: Is there compensation for stock splits?

A: While stock splits do not offer direct financial compensation, they can potentially increase market liquidity, attract more investors, and improve the overall trading environment for shareholders.